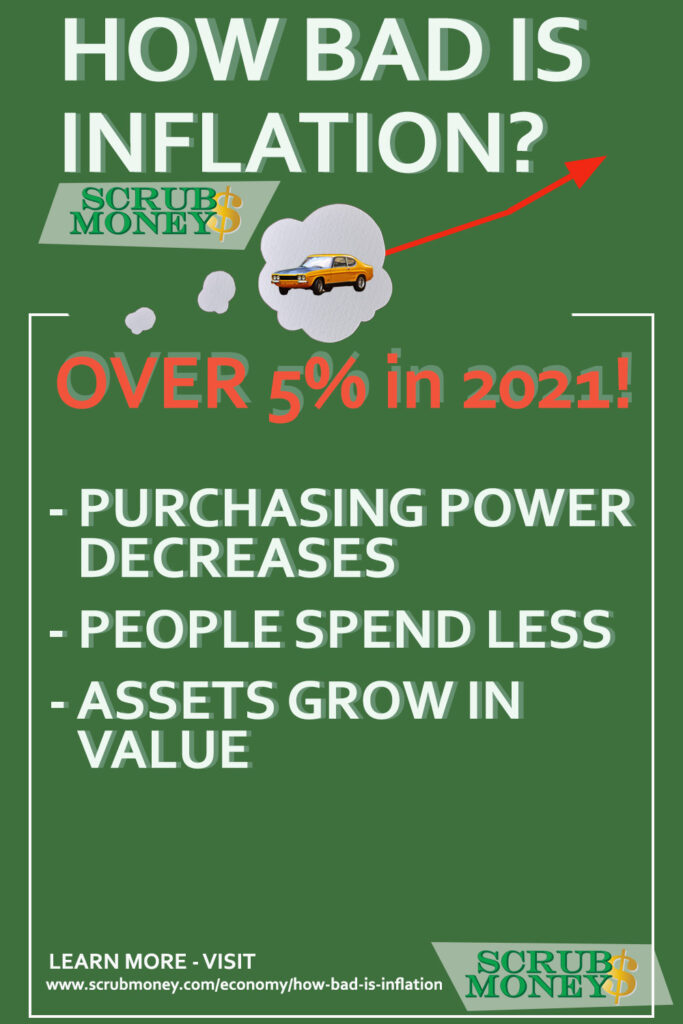

Inflation has been in the news for some time now. It is making prices go up – the cost of things we buy, energy we use and things we consume. Whether inflation is good or bad depends on who you ask. In 2021, economists have been indicating inflation at over 5% – the highest levels seen in 30 years.

Inflation rates in the United States officially closed 2021 at 7% – a rate not seen since 1981. Inflation is even higher in 2022, looking to close out at more than 8%.

So, how bad is inflation?

How Bad is Inflation?

How bad inflation is felt is set by how high it is. The Federal Reserve has aimed to keep inflation at 2%, but many experts say it is much higher than that. It is at is 30-year record highs that are using methods reported, but even higher are specific sectors. Supply chain issues, printing of money and changing demand have been made worse by the pandemic.

Inflation can be both good and bad. If you have a lot of bills, it is bad. It becomes more difficult to meet your financial obligations

Inflation is good if you own a lot of assets. Things like cars, homes, real estate, stocks, commodities and manufactured goods (inventory) go up in value. Hypothetically, if the materials and labor it takes to build a house double over night, a house built before the rise would go up equally in value as well.

If you have a lot of debt (like the US Government, or most governments), it is easier to repay those debts as long as you are also increasing revenue (income).

What Are the Effects of Inflation?

Inflation makes the prices of the things people buy go up in price. It makes the purchasing power of currency, or our dollar worth less. Everyday expenses cost more, and existing goods and assets go up in value.

Purchasing Power Decreases

Typically, less money is invested, therefore, less goods are produced. Since everything costs more, people buy less, but at an inflated price. They start saving money anyway they can in their household and company budgets to afford the necessities. This leads to less jobs, more layoffs and bankruptcies.

People & Businesses Spend Less Money

Even just thinking about inflation can give people and businesses a scare. They start to spend less money to prepare for higher prices in the future. Families make due without things they want and substitute things they need.

Businesses may put off initiatives for a later date, or try a less expensive alternative. Instead of an expensive, in house marketing team, they may outsource a salary with a low cost marketing company.

Assets Grow in Value

When prices of consumer and producer goods go up, the assets (factories, businesses, buildings, manufactured goods) go up in valued. Simply put, the components of every good and service are the components of every business, home, product and property. If a slice of pizza is worth more, so is the whole pie.

When Do We Get Deflation?

Eventually, the inflation cycle winds down and often goes through a period of deflation. This is when prices get lower, and assets become worth less than they were before. Unfortunately, deflation usually doesn’t lead to lower prices long term, because inflationary periods last longer than deflationary ones.

Sometimes economies crash and dip bellow historical lows. This rapid deflation is temporary, and the ideal time for people with money to buy assets at a discount. Unless the world ends, they go back up and exceed previous prices.

Time for a Recession

Deflation and recessions go hand and hand. Recessions typically cause prices to go down with demand, and prices go The good news is that there is opportunity during these deflationary downturns. While many companies go out of business during recessions, a lot of successful companies get formed.

Still, a lot of pain and waste is caused by this system, thought there seems to be no better option.

Who Does Inflation Affect?

Inflation affects everyone as we all use money to buy goods and services. Businesses must adjust or make less profit. Households have to plan ahead or go into debt,

If a person or companies’ income doesn’t rise with inflation, their expenses will eat up earnings and they may go into debt.

How to Protect Against Inflation

To protect against inflation, you need to save more money and invest it in assets that go up in values. While it is really that simple, it is hard to know what to invest your money in. The best way is to diversify your money and savings.

The first investment you should make is in food and household supplies. Buy the things you need and use frequently in bulk, on sale and substitute if you can. Use less by perceiving it’s value as greater than when you purchased it. With inflation, replacing that bag of coffee or other rising good is going to cost more in the future.

Is Inflation Bad?

For the average person, inflation is not good. It is a mismatch from a counties’ GDP and amount of money in circulation. High rates of inflation would not exist if the same amount of goods and resources were produced for each person every year and the same amount of currency existed for each person.

In general, inflation is bad for economies. It stifles growth, hurts consumers and small businesses most. When prices rise quickly, it causes consumers and producers a lot of pressure with budgets and future spending.